Blue Cross Blue Shield of Georgia State Health Benefit Plan Diabetes Benefits

State Health Benefit Plan (SHBP)

You may choose between Anthem and United Healthcare for your health plan coverage.

Anthem offers three Health Reimbursement Arrangement (HRA) plan options, along with an HMO plan option that provides in-network coverage only, but that includes copays for many services.

UnitedHealthcare offers an HMO similar to the Anthem plan, along with a High Deductible Health Plan (HDHP). The HDHP has the highest deductible and out-of-pocket costs, but the lowest premiums.

The Houston County School District contributes $945 per employee per month towards your medical coverage. This is an annual employer contribution amount of $11,340.

The Anthem plans include Gold, Silver, and Bronze HRA plan options, and an HMO plan option. On the HRA plan options, most services are subject to a deductible and there are no copays. After you meet your in-network deductible, you pay coinsurance up to the out-of-pocket maximum. For prescription drugs, you pay a percentage of the retail cost. The HRA plans include a board-funded Health Reimbursement Account to reduce / offset your deductible and pharmacy expenses (unused balances carry forward into new plan years). Preventive care is always covered at 100% before the deductible, and certain drug costs are waived if you participate in a Disease Management Program (diabetes, asthma and coronary artery disease). To participate, contact Anthem.

The HMO plan option has the lowest deductible out of all plans, but provides in-network coverage only. Some services (office visits, ER visits, and prescription drugs) are covered at 100% after a copay. For most other services, you are responsible for a deductible and coinsurance until you meet your out-of-pocket maximum. Please be aware that copays do not count towards your deductible. Preventive care is always covered at 100% before the deductible, and certain drug costs are waived if you participate in a Disease Management Program (diabetes, asthma and coronary artery disease). To participate, contact Anthem.

The UnitedHealthcare plans include an HMO option, and a High Deductible Health Plan (HDHP) plan option. This HMO plan has the same benefits as the Anthem HMO, but utilizes the UHC network.

The HDHP plan has the lowest premiums, highest deductible, and highest maximum out-of-pocket costs. All services, including pharmacy, are subject to the deductible and coinsurance, and there are no copays with this plan. Once you meet your deductible, you pay coinsurance until you satisfy the out-of-pocket maximum. As with the other State Health plan options, wellness incentive credits can be earned by High Deductible Health Plan members.

Transfers from Other Georgia Systems

- If you are transferring from another Georgia system, you must keep your current medical coverage for the remainder of the plan year.

- No changes are allowed to your SHBP coverage until the next Open Enrollment period, unless you have a Qualifying Life Event (QLE).

Medicare

For active employees with spouses that are enrolled in Medicare and not disabled, SHBP is primary. The spouse is not required to elect Part B (medically necessary services such as outpatient care and preventive care) until the active employee retires. However, the spouse will automatically receive Part A (hospital insurance).

Premium Information

Important Documents

| Anthem HRA Plan - Gold In | Out | Anthem HRA Plan - Silver In | Out | Anthem HRA Plan - Bronze In | Out | Anthem / UHC HMO Plan In Only (No Out-of-Network Coverage) | UHC HDHP Plan In | Out | |

|---|---|---|---|---|---|

| Deductible | |||||

| You | $1,500 | $3,000 | $2,000 | $4,000 | $2,500 | $5,000 | $1,300 | $3,500 | $7,000 |

| You + Child(ren) / Spouse | $2,250 | $4,500 | $3,000 | $6,000 | $3,750 | $7,500 | $1,950 | $7,000 | $14,000 |

| You + Family | $3,000 | $6,000 | $4,000 | $8,000 | $5,000 | $10,000 | $2,600 | $7,000 | $14,000 |

| Medical Out-of-Pocket Max | |||||

| You | $4,000 | $8,000 | $5,000 | $10,000 | $6,000 | $12,000 | $4,000 | $6,450 | $12,900 |

| You + Child(ren) / Spouse | $6,000 | $12,000 | $7,500 | $15,000 | $9,000 | $18,000 | $6,500 | $12,900 | $25,800 |

| You + Family | $8,000 | $16,000 | $10,000 | $20,000 | $12,000 | $24,000 | $9,000 | $12,900 | $25,800 |

| Coinsurance (Plan Pays) | 85% | 60% | 80% | 60% | 75% | 60% | 80% | 70% | 50% |

| HRA Credits | |||||

| You | $400 | $200 | $100 | N/A | N/A |

| You + Child(ren) / Spouse | $600 | $300 | $150 | N/A | N/A |

| You + Family | $800 | $400 | $200 | N/A | N/A |

| Medical | |||||

| ER | Coins after ded | Coins after ded | Coins after ded | $150 copay | Coins after ded |

| Urgent Care | Coins after ded | Coins after ded | Coins after ded | $35 copay | Coins after ded |

| PCP Visit | Coins after ded | Coins after ded | Coins after ded | $35 copay | Coins after ded |

| Specialist Visit | Coins after ded | Coins after ded | Coins after ded | $45 copay | Coins after ded |

| Preventive Care | 100% | None | 100% | None | 100% | None | 100% | 100% | None |

Pharmacy Benefits

CVS Caremark is the pharmacy vendor for all medical options.

- For the HRA, you pay a percentage of the cost subject to a minimum and maximum per prescription.

- For the HMO plans, prescription drugs are covered at 100% after a copay at participating pharmacies.

- For the High Deductible Health Plan, prescription drugs are subject to deductible and then coinsurance, similar to other medical services.

The pharmacy costs are included in your out-of-pocket maximums, and a mail order benefit for a 90 day supply is also available. Additional details are located in the State Health Benefit Plan Decision Guide.

Telemedicine / Virtual Visits

The medical plans include a telemedicine benefit which allows you to speak to a participating doctor from home or work through your smartphone, tablet or computer 24 hours a day / 7 days a week.

You must use in-network providers for coverage to apply. HMO members pay a copay and HRA members pay coinsurance for telemedicine. High Deductible Health Plan members can access this benefit subject to the health plan deductible.

Consider this convenient benefit for non-complex medical conditions. Download the LiveHeath mobile app today!

Enrollment - ADP Portal

How to complete your State Health Benefit Plan (SHBP) Enrollment through the ADP Portal.

- Access https://myshbpga.adp.com/shbp to review your health coverage elections. Your registration code is "SHBP-GA."

How to Reset Your Password

Step 1: Click Forgot Your Password.

Step 2: Enter your User ID.

Step 3: Follow the instructions to answer a series of security questions.*

Step 4: Create a new password.

Step 5: Click Continue.

* Note: If you do not know the answers to the security questions, contact SHBP Member Services at 800-610-1863 for assistance in resetting your password. You will have three tries in total to answer the security questions before your account is locked and you must begin the process again.

Dependent Verification

- If you wish to add dependent(s) (spouse and / or children) to your health plan, ADP will contact you (by mail and email) to request appropriate verification documents. If you do not receive the request, contact SHBP directly to have the request sent to you. They can be reached at 800-610-1863.

- The communication from ADP will include a personalized fax cover sheet with a bar code that must be used when submitting documentation.

- Appropriate documentation must be attached to the fax cover page and provided by the deadline set by ADP.

- Dependents will not be covered until they are approved. Non-verified dependents cannot be reinstated until the next open enrollment period and would require appropriate documentation.

- Additional information can be found on the SHBP website.

Additional Resources

Go Online for More Resources

Access the two following plan websites to locate the participating providers and to find health and wellness tools, plan details, and to print ID cards.

Anthem of Georgia

www.anthem.com/shbp

Select "Find Care' from the Main Menu and then follow instructions to find a doctor.

UnitedHealthcare

www.whyuhc.com/shbp

Select "Find a Doctor or Facility" under the Benefits drop down. Select "Choice HMO" or "HDHP with HSA" and follow the search instructions.

Other Medical Plan Options

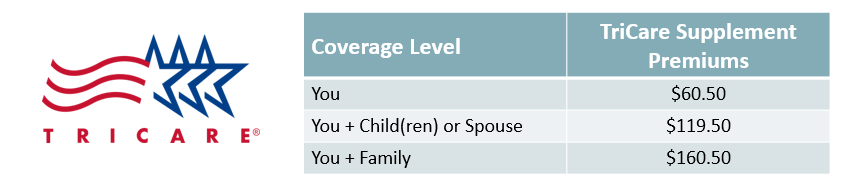

TriCare Supplement Plan

The TriCare Supplement Plan is available for retired military employees, and is a supplement to your current TriCare benefits. The plan provides reimbursement of copays and other medical expenses associated with your current TriCare plan. Additional information can be found here.

PeachCare for Kids

The state of Georgia offers an affordable health insurance program called PeachCare for Kids. This plan provides healthcare, dental, and vision benefits for children up to age 19. To learn if you are eligible, and to obtain benefits, cost, and application information, click here.

Source: https://hcbebenefits.com/coverage/state_health